Martin Corporation granted an incentive stock option to employee Caroline on January 1, 2012. The option price was $150, and the FMV of the Martin stock was also $150 on the grant date. The option allowed Caroline to purchase 160 shares of Martin stock. Caroline exercised the option on August 1, 2016, when the stock's FMV was $250. Unless otherwise stated, assume Caroline is a qualifying

employee. If Caroline sells the stock on September 5, 2018, for $350 per share, she must recognize (ignore alternative minimum tax)

A) 0. No gain or loss is recognized at exercise or sale with incentive stock options.

B) long-term capital gain of $16,000 in 2018.

C) ordinary income of $16,000 on the exercise date and a long-term capital gain of $16,000 in 2018.

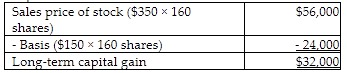

D) long-term capital gain of $32,000 in 2018.

D) long-term capital gain of $32,000 in 2018.

You might also like to view...

Pierce Corp identified the following data in preparing a bank reconciliation on October 31, 2014. Bank statement balance $29,600 Pierce's book balance (before adjustments) ? Outstanding checks 3,100 NSF checks 300 Service charges 200 Deposits in transit 2,200 Interest earned on checking account 100 What is the net amount of the adjustments to Pierce's cash balance as a result of the bank

reconciliation? a. No amounts need to be recorded b. $400 increase c. $400 decrease d. $900 decrease

Which of the following does your text list as a common mistake among professionals?

a. neglecting to take an inventory of others in the working environment b. failing to develop a rapport with their superiors c. failing to develop a rapport with their subordinates d. none of the above

As noted in your text, what tool is very useful for marketing low-involvement products?

A. company websites B. in-store salespeople C. in-store promotion D. television commercials E. newspaper advertising

________ are specific government organizations in a firm's more immediate task environment.

A. Prospectors B. Stakeholders C. Open systems D. Regulators E. Defenders