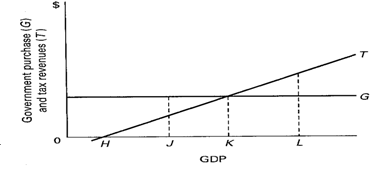

Explain how the below graph illustrates the built-in stability of a progressive tax structure.

The graph illustrates how net taxes are negative as GDP declines which will add to aggregate demand. When GDP expands, tax revenues increase which dampens aggregate demand.

You might also like to view...

Suppose the Economics Department has a graduation party for its students but as a final test they must show they have learned something about trade. The men are given food when they walk in and the women are given drink. Suppose they have identical preferences where food and drink provide utility U = F?D? . The contract curve in the Edgeworth box using a representative man and woman would be

a. a right angle connecting the lower left corner with the upper right corner. b. a curve (not necessarily a line) connecting the lower left corner with the upper right corner. c. a line connecting the lower left corner with the upper right corner. d. a right angle connecting the upper left corner with the lower right corner.

Which of the following is true of fiscal policy before the Great Depression of the 1930s?

a. Fiscal policy was made at the federal level. b. Policies associated with national defense were made at the state level. c. Environmental degradation and education were the focus areas of the federal government while other areas of government policy were dealt by individual states. d. The federal budget was determined mostly by economists and not by politicians. e. National defense and foreign trade were the focus areas of the federal government while other areas of government policy were dealt by individual states.

The expected effects of fiscal contraction are

A. higher real interest rates. B. exchange rate depreciation. C. increased trade deficit. D. All of these responses are correct.

Which of the following would cause the level of income to change by the greatest amount, ceteris paribus?

A. A reduction in personal income taxes of $10 billion. B. An increase in Social Security payments of $10 billion. C. An increase in defense spending of $10 billion. D. All of the other choices have equal impacts on the level of income.