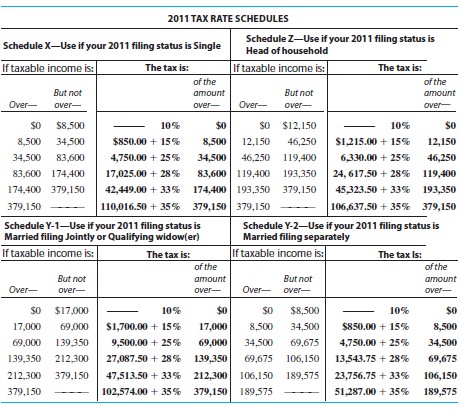

Find the tax. Use $3700 for each personal exemption; a standard deduction of $5800 for single people, $11,600 for married people filing jointly, $5800 for married people filing separately, and $8500 for head of a household; and the tax rate schedule.  Glenn and Natalie Dowling had combined wages and salaries of $69,992, other income of $5234, dividend income of $322, and interest income of $667. They have adjustments to income of $2411. Their itemized deductions are $8441 in mortgage interest, $1617 in state income tax, $852 in real estate taxes, and $1181 in charitable contributions. The Dowlings filed a joint return and claimed six exemptions.

Glenn and Natalie Dowling had combined wages and salaries of $69,992, other income of $5234, dividend income of $322, and interest income of $667. They have adjustments to income of $2411. Their itemized deductions are $8441 in mortgage interest, $1617 in state income tax, $852 in real estate taxes, and $1181 in charitable contributions. The Dowlings filed a joint return and claimed six exemptions.

A. $5076.95

B. $5150.60

C. $7328.25

D. $6890.60

Answer: A

Mathematics

You might also like to view...

Rewrite the equation such that each resulting term or combination is in an integrable form.e-y dx - 4x dx = xe-y dy

A. (e-y dx - xe-y dy) - 4x dx = 0

B. (e-y dx + xe-y dy) - 4x dx = 0

C.  - 4 dx = 0

- 4 dx = 0

D. (4x dx + xe-y dy) - e-y dx = 0

Mathematics

Solve the problem.A circular pond is being installed in the corner of a yard, as shown. The installer needs to know the value of x in feet. Find x to the nearest tenth of a foot.  ?15 ft

?15 ft

A. 4.6 ft B. 4 ft C. 3.7 ft D. 4.4 ft

Mathematics

Solve the equation. Use natural logarithms. When appropriate, give solutions to three decimal places unless otherwise indicated.eln 6x = eln(5x + 5)

A. {5}

B.

C.

D. {-5}

Mathematics

Rationalize numerator.

A.

B.

C.

D.

Mathematics