The table below shows the pre-tariff and post-tariff prices, domestic production, and consumption of copper in the United States. Suppose the U.S. government imposes a specific tariff of $0.20 per pound on copper imports by the country. Pre-tariffPost-tariffWorld price$0.50 per lb.$0.40 per lb.U.S domestic price$0.50 per lb.$0.60 per lb.U.S consumption250 million lb.210 million lb.U.S production100 million lb.140 million lb. a. Calculate the loss to U.S. consumers of copper from the tariff.b. Calculate the gain to U.S. producers of copper from the tariff.c. Calculate the revenue collected by the U.S. government from taxing copper imports.d. Calculate the net gain or loss to the U.S. economy as a whole from the tariff.

What will be an ideal response?

POSSIBLE RESPONSE:

a. As a result of the tariff the domestic price rises by $0.10 (from $0.50 to $0.60) per pound. Domestic consumption in the United States declines by (250 ? 210) = 40 million pounds. The decline in the consumer surplus arising from the higher domestic price is $23 million, equal to the $21 million loss for the 210 million units that consumers continue to purchase plus the $2 million loss on the 40 million units that consumers no longer purchase.

b. U.S. producers receive $0.10 more per pound and expand their production by 40 million pounds. The gain in producer surplus from greater production is (½ × $0.10 × 40 million) = $2 million. The gain in surplus arising from selling the initial output at a higher price is (100 million × $0.10) = $10 million. Therefore, the total gain in producer surplus is $12 million.

c. The tariff revenue to the U.S. government equals the product of the imported quantity and the tariff per unit. After imposing the tariff, U.S. imports decline to (210 ? 140) = 70 million pounds. U.S. revenue is ($0.20 × 70 million) = $14 million.

d. The net gain to the United States as a whole is given by the difference between the part of the tariff burden borne by the foreign exporters and the sum of the losses arising from the production and consumption effects of the tariff. The part of the tariff burden borne by foreign exporters equals $7 million. The loss arising from the production and consumption effects sum to $4 million. Therefore, the net gain to the United States from the tariff is $(7 ? 4) million = $3 million.

You might also like to view...

The supply curve that monopsonists face is different from the supply curves that firms in competitive labor markets face because with a monopsony,

a. d and e. b. the supply curve of labor is relatively flat. c. offering a wage lower than the market wage means having no workers. d. the employer faces the market supply curve. e. the firm does not take the wage as given.

Which of the following correctly explains why sellers in a perfectly competitive market are price takers?

A. There are few sellers, and so they have the power to take whatever price they want. B. There are many sellers, and so the market process generates an equilibrium price that cannot be influenced by any one seller. Thus they have no choice but to take the price generated by the market process. C. Sellers in a competitive market have the power to influence price by colluding with one another and using quotas to limit overall market output and thus raise price. D. Individual buyers in a competitive market have the power to influence price, and thus can impose prices and other conditions on powerless sellers.

A classical model of the economy predicts

A. a negative unemployment rate whenever the economy is in equilibrium. B. full employment in the long run. C. cyclical changes in the unemployment rate. D. the same unemployment rates as the Keynesian model.

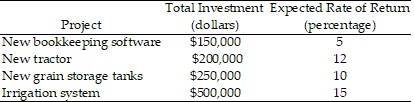

Refer to the data provided in Table 11.2 below to answer the following question(s). Table 11.2  Refer to Table 11.2. When the interest rate ________, the farmer will engage in no investment.

Refer to Table 11.2. When the interest rate ________, the farmer will engage in no investment.

A. is less than 5% B. is greater than 15% C. is greater than 5% D. is less than 15%