Assuming well-defined indifference curves, when marginal utility is zero, total utility is at a maximum.

Answer the following statement true (T) or false (F)

True

You might also like to view...

Differentiate between asset management companies and venture capital funds

What will be an ideal response?

Goodyear benefitted when the Federal Reserve ________ in 2008. This Fed action would help increase demand for its tires, which allowed Goodyear to increase employment and increase prices

A) implemented a series of open market sales of Treasury bonds B) drove down interest rates C) increased the discount rate D) lowered the required reserve rate

In the interest rate parity condition with imperfect substitutes and a risk premium of ?

A) an increased stock of domestic government debt will raise the difference between the expected returns on domestic and foreign currency bonds. B) a decreased stock of domestic government debt will raise the difference between the expected returns on domestic and foreign currency bonds. C) an increased stock of domestic government debt will reduce the difference between the expected returns on domestic and foreign currency bonds. D) an increased stock of domestic government debt will have no effect on the difference between the expected returns on domestic and foreign currency bonds. E) a decreased stock of domestic government debt will have no effect on the difference between the expected returns on domestic and foreign currency bonds.

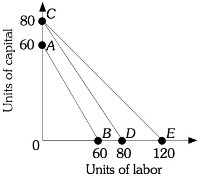

Refer to the information provided in Figure 7.8 below to answer the question(s) that follow.  Figure 7.8Refer to Figure 7.8. The firm is currently along isocost CE. If the price of capital is $24, then the price of labor is

Figure 7.8Refer to Figure 7.8. The firm is currently along isocost CE. If the price of capital is $24, then the price of labor is

A. $16. B. $24. C. $80. D. $120.