The problem of moral hazard exists when:

A. a bank is solvent but many of its assets are illiquid.

B. agencies like the Fed act based on politics rather than sound economics.

C. the failure of one financial institution can lead to the failure of other institutions.

D. people or institutions, who are insured, tend to take on too much risk.

Ans: D. people or institutions, who are insured, tend to take on too much risk.

You might also like to view...

A bank is in the position to make loans when required reserves

A. are less than actual reserves. B. are greater than actual reserves. C. equal actual reserves. D. equal excess reserves.

Utility measures the

a. income a consumer receives from consuming a bundle of goods. b. satisfaction a consumer receives from consuming a bundle of goods. c. satisfaction a consumer places on her budget constraint. d. All of the above are correct.

"Does the analysis create an accurate perception of the work?" is a question answered by _____.

A. reliability B. validity C. acceptability D. usefulness

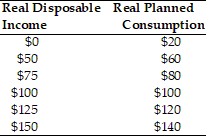

Use the above table. When real disposable income is $125

Use the above table. When real disposable income is $125

A. MPS = 0.96. B. APS = 0.20. C. APC = 0.96. D. APC = 0.80.