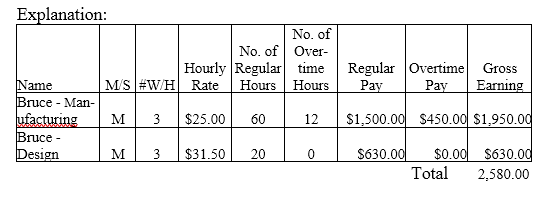

Bruce is a nonexempt employee at Grissom Industries, where he works in both the manufacturing and design departments. He is married with three withholding allowances and is paid biweekly. He earns $25 per hour in the manufacturing department and $31.50 per hour in the design department. During the most recent biweekly pay period, he worked a total of 92 hours, 20 of which were in the design

department. All overtime was in the manufacturing department. What is his gross pay? (Do not round interim calculations. Round final answer to 2 decimal places.)

A) $2,580.00

B) $2,638.50

C) $2,697.00

D) $3,147.00

A) $2,580.00

You might also like to view...

The cash basis separates the recognition of revenue from the process of earning those revenues

Indicate whether the statement is true or false

One of the foundational research projects in public relations was the study of Excellence in Public Relations and Communication Management, conducted in the 1980s. This project was supported by a grant from which organization?

A. Plank Center for Leadership in Public Relations B. IABC Research Foundation C. The Arthur W.

The type of funds most frequently used by businesses is externally generated funds.

Answer the following statement true (T) or false (F)

Preferred Contractors was a general contractor and owner of a condominium complex that was under construction. Barrett, a subcontractor, had been hired by Henderson Plumbing, another subcontractor, to help it complete the plumbing work on the project

When Henderson began using shoddy installation procedures and subsequently fell behind the scheduled completion time for the project, Preferred Contractors urged Barrett to correct Henderson's mistakes and to finish the job. Barrett refused to continue until he knew who would pay him, since he feared Henderson's financial position was shaky. Nonetheless, Preferred Contractors' job superintendent told Barrett to go ahead even if Barrett and Preferred Contractors had no contract because "he would use his influence to try to help Barrett get his money." Barrett finished the work and sent a $7,500 bill to Henderson, which was never paid. When Barrett later sent the bill to Preferred Contractors, these facts emerged: Preferred Contractors told him that due to Barrett's failure to notify Preferred Contractors promptly of Henderson's non-payment, Preferred Contractors had already paid Henderson in full and therefore would not pay twice for the work. Discuss the best possible theory of recovery Barrett may argue.