Landmark Corp. buys $300,000 of Schroeter Company's 8%, 5-year bonds payable, at par value on September 1. Interest payments are made semiannually. Landmark plans to hold the bonds for the 5-year life. When the bonds mature, the journal entry to record the proceeds will be:

A. Debit Cash $300,000; credit Interest Revenue $300,000.

B. Debit Cash $300,000; credit Interest Receivable $300,000.

C. Debit Cash $300,000; credit Bonds Payable $300,000.

D. Debit Cash $300,000; credit Debt Investments-HTM $300,000.

E. Debit Long-Term Investments-HTM $300,000; credit Cash $300,000.

Answer: D

You might also like to view...

One of the primary characteristics of the partnership form of organization is its limited liability

a. True b. False Indicate whether the statement is true or false

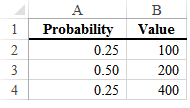

Use the function ExpValue, defined below. If you apply this function to the data in the image, where Values = B2:B4, and Weights = A2:A4, what is the value of EV when t=2?

Public Function ExpValue(Values As Range, Weights As Range)

Dim t As Integer, VarCount As Integer, EV As Single

VarCount = Values.Count

EV = 0

For t = 1 To VarCount

EV = EV + Values(t) * Weights(t)

Next t

ExpValue = EV

End Function

a) $25

b) $50

c) $125

d) $225

e) $250

Match the following.1.Direct labor, direct materials, and manufacturing overhead. a. Gross margin 2.Costs that are expensed in the period they are incurred. b.Controllable costs3.Sales less variable expenses. c. Manufacturing margin 4.Cost a manager can determine or greatly affect the amount.d. Absorption costing 5.A costing method that includes only variable manufacturing costs. e. Period costs 6.An income statement format that focuses on cost behavior. f. Contribution margin 7.Sales less cost of goods sold. g. Variable costing 8.A costing method that includes all manufacturing costs. h. Product costs 9.Fixed costs divided by contribution margin per unit. i. Contribution format 10.Sales less variable production costs. j. Break-even in units

What will be an ideal response?

Dina takes out a student loan from Earnest Bank. When she fails to make the scheduled payments for six months, Earnest advises her of further action that it will take. This is a violation of A) no federal law

B) the Fair and Accurate Credit Transactions Act. C) the Fair Debt Collection Practices Act. D) the Truth-in-Lending Act.