What is meant by the term "internalizing an externality"? How does a Pigovian tax or subsidy internalize an externality?

What will be an ideal response?

Internalizing an externality refers to transferring the external benefit or cost to the producer or consumer that generates the externality. A Pigovian tax transfers a negative externality in production back to the producer, which reduces the supply of the product and results in an efficient level of output. A Pigovian subsidy transfers a positive externality in consumption back to the consumer, which increases the demand for the product and results in an efficient level of output.

You might also like to view...

Long-run producer surplus in a perfectly competitive industry accrues mainly to:

a. suppliers of inputs with inelastic supply curves. b. suppliers of inputs with elastic supply curves. c. firms' owners. d. marginal consumers.

The expenditure approach to GDP accounting includes:

a. consumption b. investment. c. net exports. d. all of the above.

What effect does the following transaction have on the U.S. balance of payments?(Choose the proper debit and credit entries.) Colgate Inc (U.S.) receives profits from its foreign affiliates. Payment is made in U.S. dollars

a. Debit the U.S. financial account; credit the U.S. current account. b. Credit the U.S. financial account; debit the U.S. current account. c. Debit the U.S. financial account; credit the U.S. financial account. d. Credit the U.S. financial account; debit errors and omissions.

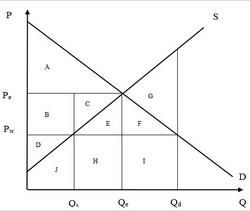

Use the following figure showing the domestic demand and supply curves for product B in a hypothetical economy to answer the next question, After trade, at a world price of Pw, the net gain of consumer surplus equals area(s)

After trade, at a world price of Pw, the net gain of consumer surplus equals area(s)

A. B + C. B. D. C. B + C + E + F. D. E + F.