You have invested $1,000 in a stock whose price is increasing at 10 percent a year. Your stock broker, who is never wrong, recommends a stock rising at 20 percent a year. Assuming the broker earns 4 percent of the stock's value on any purchase or sale of the stock, should you take her recommendation?

You will earn $200 a year if you take the recommendation. This exceeds the opportunity cost: $100 forgone on the current stock, $40 to the broker when you sell the current stock, and $40 when you buy the new stock, for a total of $180 . You gain $20, or 2 percent additional profit on your $1,000.

You might also like to view...

What does the Coase Theorem predict?

What will be an ideal response?

The "tragedy of the commons" refers to the phenomenon where

A) there is rivalry in consumption. B) people overuse a common resource. C) people do not internalize an externality. D) individuals are free riders.

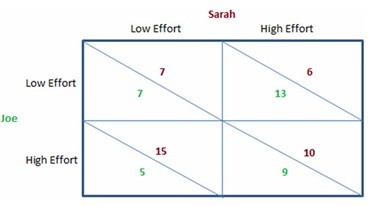

This figure shows the payoffs involved when Sarah and Joe work on a school project together for a single grade. They both will enjoy a higher grade when more effort is put into the project, but they also get pleasure from goofing off and not working on the project. The payoffs can be thought of as the utility each would get from the effort they individually put forth and the grade they jointly receive.The outcome of the game in the figure shown will be:

This figure shows the payoffs involved when Sarah and Joe work on a school project together for a single grade. They both will enjoy a higher grade when more effort is put into the project, but they also get pleasure from goofing off and not working on the project. The payoffs can be thought of as the utility each would get from the effort they individually put forth and the grade they jointly receive.The outcome of the game in the figure shown will be:

A. Joe and Sarah both put forth low effort. B. Joe puts forth high effort and Sarah puts forth low effort. C. Joe and Sarah both put forth high effort. D. Joe puts forth low effort and Sarah puts forth high effort.

The optimal bid in a first-price, sealed-bid auction with independent private values is to bid:

A. less than the true value of the item. B. the true value of the item and more than the true value of the item, depending upon whether value estimates are affiliated. C. the true value of the item. D. more than the true value of the item.