Describe the condition that would have a call option in the money. Now describe the condition that has a put option out of the money.

What will be an ideal response?

A call option will be in the money when the strike price is below the spot or current market price. The option holder has the right to call the asset away from the option writer at a price below what the asset could be sold for on the spot market. A put option is out of the money when the strike price is below the spot or market price. Here the option holder has the right to put (sell) the asset to the option writer at a predetermined (strike) price. If the strike price is below the market price the option holder would be better off selling the asset on the spot market versus selling it to the option writer.

You might also like to view...

Refer to Table 16-2. What are the total profits from both markets combined?

A) $50 B) $48 C) $18 D) $15

In many countries, education is either wholly provided by the government or is heavily subsidized. How would an economist explain this?

A. Since education has a spillover? benefit, private markets will under provide for it. B. Education is a pure public good and those who do not pay cannot be excluded from it. C. Individuals will not purchase education because they do not benefit from it. D. Since education has a spillover? cost, private markets will over provide for it. E. The only way to provide education is through a? government-sponsored system.

Suppose that consumers become more pessimistic about the future and, as a result, reduce their consumption by $10 billion. If the marginal propensity to consume is 0.80, how will this $10 billion reduction in consumption affect the equilibrium level of real GDP?

a. Real GDP will decrease by $8 billion. b. Real GDP will decrease by $10 billion. c. Real GDP will decrease by $40 billion. d. Real GDP will decrease by $50 billion.

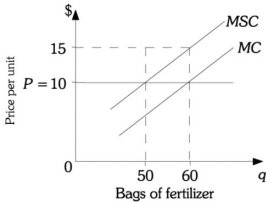

Refer to the information provided in Figure 16.1 below to answer the question(s) that follow.  Figure 16.1 Refer to Figure 16.1. What is the total damage imposed as a result of producing the efficient level of fertilizer?

Figure 16.1 Refer to Figure 16.1. What is the total damage imposed as a result of producing the efficient level of fertilizer?

A. $0 B. $250 C. $300 D. $500