Which of the following taxes is based on the benefit principle?

a. Income taxes paid for national defense

b. Payroll taxes paid for Social Medicare

c. Education taxes paid by parents

d. Income taxes paid for scientific research

c

You might also like to view...

Answer the next question on the basis of the following cost data for a perfectly competitive firm.Total ProductAverage Fixed CostAverage Variable CostAverage Total CostMarginal Cost1$100.00$17.00$117.00$17250.0016.0066.0015333.3315.0048.3313425.0014.2539.2512520.0014.0034.0013616.6714.0030.6714714.2915.7130.0026812.5017.5030.0030911.1119.4430.55351010.0021.6031.6041119.0924.0033.0948128.3326.6735.0056Which of the following represents the firm's short-run supply schedule?(1)(2)(3)(4)PQsPQsPQsPQs$5012$5012$5011$50114220421142104210368369369369328328328328206206206206130135130135

A. Table (1) B. Table (2) C. Table (3) D. Table (4)

Based on the data in the table above, after which worker is hired do diminishing marginal returns begin?

A) the first B) the fifth C) the sixth D) the ninth

When decentralized governmental units operate independently and compete with each other, governments will attract residents and expand their tax base when

A) they discontinue desired government services in order to keep taxes low. B) they increase their tax rates. C) they provide residents with desired services at an attractive tax cost. D) they provide residents with fewer government services.

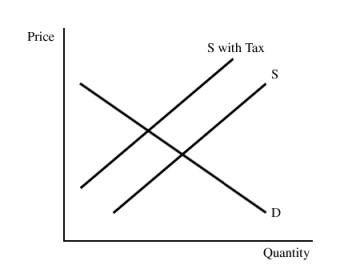

Figure 16.4The pollution tax in Figure 16.4:

Figure 16.4The pollution tax in Figure 16.4:

A. reduces equilibrium output. B. reduces pollution associated with the production of the good. C. raises equilibrium price. D. All of these