Which of the following statements is false? An economic analysis of carbon taxes can:

A) calculate the increase in costs faced by coal-using industries.

B) predict the effect on unemployment in West Virginia coal mining communities.

C) compare the likely reductions in medical expenditures on diseases caused by smog.

D) present a trade-off of the costs and benefits of different levels of carbon taxes.

E) conclude that such taxes should be imposed to benefit future generations.

E

You might also like to view...

If Joey goes surfing for four hours instead of earning $10 per hour for those four hours, his opportunity cost is

A) the good time spent surfing. B) the cost of gasoline used to get to the beach. C) the travel time to the beach. D) $40.

A decrease in the price of a complement shifts the demand curve to the

a. right b. left c. it does not change the demand curve d. none of the above

Renewable resources are those for which

a. additional units can be purchased in the market b. additional units can be purchased in the market or provided by government c. worn-out units can be repaired for further use d. periodic use can be continued indefinitely e. additional sources are constantly being discovered

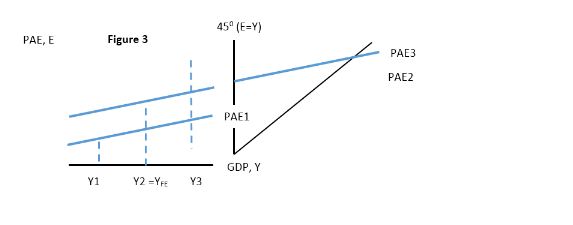

Using Figure 3 below the distance between what 2 lines illustrate an inflationary expenditure gap?

A. PAE2 to PAE3

B. PAE1 to PAE2

C. Y1 to Y2

D. Y2 to Y3