Why are financial institutions required to keep reserves?

What will be an ideal response?

Reserves are required to constrain the amount of bank lending (money creation) that can occur. Without required reserves, theoretically banks would have unlimited power to lend and thereby, expand the money supply without any limit.

You might also like to view...

We can roughly estimate how long it will take a country to double its real GDP per capita using the:

A. rule of 70. B. rule of 60. C. growth estimator. D. GDP deflator.

Suppose Hillary values a large order of French fries at $4 . Bill values a large order of French fries at $7 . The pre-tax price of a large order of French fries is $2 . The government imposes a "fat tax" of $3 on each large order of French fries, and the price rises to $5 . The deadweight loss from the tax is

a. $4, and the deadweight loss comes from both Hillary and Bill. b. $4, and the deadweight loss comes only from Hillary because she does not buy a large French fries after the tax. c. $2, and the deadweight loss comes from both Hillary and Bill. d. $2, and the deadweight loss comes only from Hillary because she does not buy a large French fries after the tax.

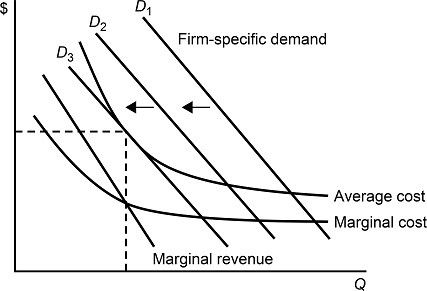

Figure 8.3 shows demands and costs for a monopolistically competitive firm. When the firm's demand curve shifts from D1 to D2 and to D3:

Figure 8.3 shows demands and costs for a monopolistically competitive firm. When the firm's demand curve shifts from D1 to D2 and to D3:

A. the firm's economic profit remains the same. B. the firm's marginal revenue at the profit-maximizing output level is decreasing. C. the firm's marginal cost at the profit-maximizing output level is increasing. D. the firm's average cost at the profit-maximizing output level is decreasing.

When the text refers to rational self-interest, it means

A. behavior that makes society better off. B. behavior that hurts other people. C. your focus on your own contributions to society. D. your looking out for what is best for you as an individual.