Assume all banks in the system started have a 10 percent required reserve ratio and the Fed made a $20,000 open market purchase. The result would be a(n):

A. $200,000 expansion of the money supply.

B. $20,000 expansion of the money supply.

C. $20,000 contraction of the money supply.

D. infinite contraction of the money supply.

Answer: A

You might also like to view...

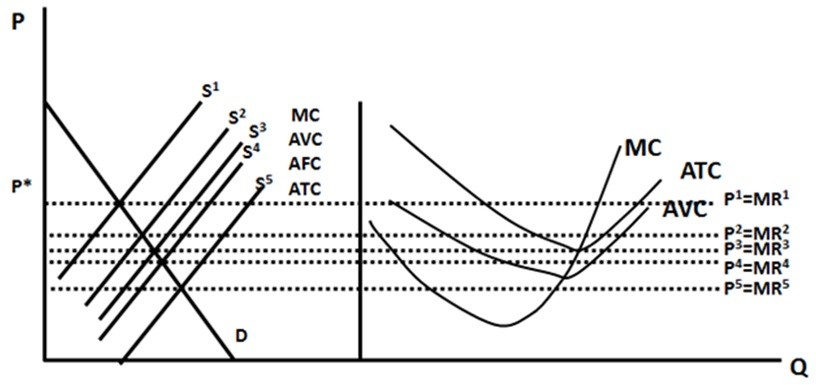

Refer to the figure below. In response to gradually falling inflation, this economy will eventually move from its short-run equilibrium to its long-run equilibrium. Graphically, this would be seen as

A. long-run aggregate supply shifting leftward B. Short-run aggregate supply shifting downward C. Aggregate demand shifting rightward D. Aggregate demand shifting leftward

Mary has $1,000 and is considering purchasing a $1,000 bond that pays 7 percent interest per year. Mary decides not to buy the bond and holds the $1,000 as cash

If the inflation rate is 4 percent, the opportunity cost of holding the $1,000 as money is A) $40.00. B) $30.00. C) $70.00. D) $110.00. E) $100.00.

What is the United States government's formal definition of the poverty line?

A) It is a level of annual income equal to total income in society divided by the population, adjusted for a family of four. B) It is the annual income level below which a household is exempt from taxes. C) It is a level of annual income equal to the amount of money necessary to purchase the minimal quantity of food required for adequate nutrition. D) It is a level of annual income equal to three times the amount of money necessary to purchase the minimal quantity of food required for adequate nutrition.

In Figure 5.8, if the supply curve moves from S4 to S5,

A. the firm will make a smaller economic profit than they used to. B. the firm will go from making a loss to a bigger loss but one that is not big enough to make it want to shutdown. C. the firm will go from making an economic profit to a normal profit. D. the firm will go from making a loss to a bigger loss that is big enough to make it want to shutdown.