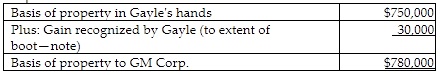

Individuals Gayle and Marcus form GM Corporation. Gayle transfers land and a building with a $750,000 adjusted basis and a $830,000 FMV in exchange for 50% of the stock of the GM Corporation worth $800,000 and a $30,000 note. Marcus transfers cash of $830,000 for 50% of the stock worth $800,000 and a note of the GM Corporation valued at $30,000. The basis of the land and building to GM

Corporation is

A) $750,000.

B) $780,000.

C) $830,000.

D) $860,000.

B) $780,000.

You might also like to view...

Crosson Corporation operates its factory 300 days per year. Its annual consumption of Material Y is 1,200,000 gallons. It carries a 10,000 gallon safety stock of Material Y and its lead time is 12 business days. Refer to Crosson Corporation. What is the order point for Material Y?

a. 10,000 gallons b. 38,000 gallons c. 48,000 gallons d. 58,000 gallons

The tenth and last step in the accounting cycle is the recording and posting of the closing entries of the business

Indicate whether the statement is true or false

The Small Business Administration, ____ protects the interests of small businesses, is a federal agency

A) who B) which C) whom

Almost 40 percent of ________ could be achieved at negative marginal costs, meaning that investing in these options would generate positive economic returns over their life cycle

A) greenhouse gas abatement B) fuel consumption initiatives C) increased customer base D) improved company reputation