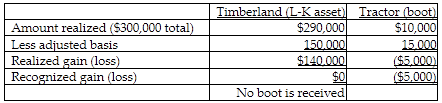

Whitney exchanges timberland held as an investment for undeveloped land with a $300,000 FMV. Whitney's basis for the timberland is $150,000. She also transfers her tractor with a $15,000 basis and a $10,000 FMV as part of the exchange.

a. What is the amount, if any, of gain or loss recognized on the transaction?

b. What is the basis of the undeveloped land?

a.

The tractor is non-like-kind property. Therefore, Whitney will recognize the loss on the transfer of $5,000 ($10,000 FMV - $15,000 basis).

b. Whitney's basis for the undeveloped land is $160,000:

$150,000 basis of timberland + $15,000 basis of tractor - $5,000 loss recognized, or

$300,000 FMV undeveloped land - $140,000 unrecognized gain.

You might also like to view...

Contributed capital does not include subscribed stock because it has not been issued yet

Indicate whether the statement is true or false

Soledad and Winston are partners who share income in the ratio of 1:3 and have capital balances of $100,000 and $140,000 at the time they decide to terminate the partnership. After all noncash assets are sold and all liabilities are paid, there is a cash balance of $130,000. What amount of loss on realization should be allocated to Soledad?

A) $60,000 B) $27,500 C) $92,500 D) $32,500

Which of the following statements is true in comparing the AON method with the AOA method?

a. The AON method is more difficult to visualize. b. The AOA method is more costly. c. The AON method is more commonly used. d. Most popular project management packages use the AOA method.

Which of the following correctly describes the accounting for factory depreciation?

A) Factory depreciation is a product cost and is expensed as incurred. B) Factory depreciation is a period cost and is expensed as incurred. C) Factory depreciation is a product cost and is expensed when the manufactured product is sold. D) Factory depreciation is a period cost and is expensed when the manufactured product is sold.