Adams Bakery uses the modified half month convention to calculate depreciation expense in the year an asset is purchased or sold Adams has a calendar year accounting period and uses the straight-line method to compute depreciation expense. On March 17, 2016, Adams acquired equipment at a cost of $200,000. The equipment has a residual value of $40,000 and an estimated useful life of 6 years. What amount of depreciation expense will be recorded for the year ending December 31, 2016? (Round your answer to the nearest dollar.)

A) $26,667

B) $22,222

C) $20,000

D) $13,333

C .Depreciation for 2017 = $200,000 - 40,000 / 6 years x 9 months / 12 months = $20,000

You might also like to view...

At the principled level of moral development, an individual values the rights of others and upholds absolute values and rights regardless of the majority's opinion.

Answer the following statement true (T) or false (F)

Which of the following is NOT an asset?

A) Revenues B) Accounts Receivable C) Prepaid Rent D) All of the above are assets.

On January 4, 2018, Mason Co. purchased 40,000 shares (40%) of the common stock of Hefly Corp., paying $560,000. At that time, the book value and fair value of Hefly's net assets was $1,400,000. The investment gave Mason the ability to exercise significant influence over the operations of Hefly. During 2018, Hefly reported income of $150,000 and paid dividends of $40,000. On January 2, 2019, Mason sold 10,000 shares for $150,000.What is the appropriate journal entry to record the sale of the 10,000 shares? A)Cash150,000 Investment in Hefly 150,000B)Cash150,000 Investment in Hefly 130,000 Gain on sale of investment 20,000C)Cash150,000 Loss on investment1,000 Investment in Hefly 151,000D)Cash150,000 Investment in Hefly 149,000 Gain on sale of

investment 1,000E)Cash150,000 Loss on sale of investment10,000 Investment in Hefly 160,000 A. A Above. B. D Above. C. E Above. D. C Above. E. B Above.

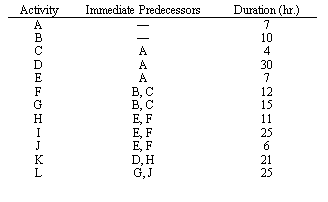

By how much can activities G and L be delayed without delaying the entire project?

Consider a project that has been modeled as follows: