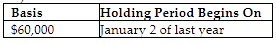

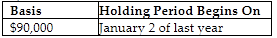

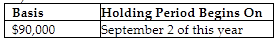

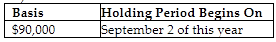

Ajax and Brindel Corporations have filed consolidated returns for several calendar years. Ajax acquires land for $60,000 on January 1 of last year. On September 1 of this year, Ajax sells the land to Brindel for $90,000. The basis and holding period for the land acquired by Brindel are:

A)

B)

C)

D) none of the above

C)

You might also like to view...

The objective of financial reporting established by the FASB is to provide information that is useful to potential customers

Indicate whether the statement is true or false

________ is a clause in a contract in which the parties specify certain events that will excuse nonperformance

A) Approval clause B) Express condition C) Force majeure D) Implied-in-fact condition

Angelica has been asked to learn how many pedestrians walk by a specific location that her company is considering for a new sporting goods retail shop. Probably the most useful way to research this information would be by ________

A) manually searching resources in her public library B) searching the Web C) investigating primary sources D) conducting a scientific experiment with controlled variables

To improve orientation, you need candid, comprehensive feedback from everyone involved in the program.

Answer the following statement true (T) or false (F)