IFRS and GAAP differ in the application of the fair value concept for impairment tests applied to intangible assets.Required:Describe the fair value concept as it is applied for impairment tests in IFRS and GAAP, highlighting the differences.

What will be an ideal response?

As a measure of fair value, GAAP uses the amount at which the asset could be sold in a current transaction between market participants. IFRS calculate the fair value in two ways and then require use of the higher of the two estimates. The first approach is a net realizable approach, using the fair value less costs to sell. The alternative IFRS approach is to value in use which is the present value of expected future cash flows. While the first approach of the IFRS is a disposal value approach similar to GAAP, the value-in-use approach is not contemplated in GAAP.

You might also like to view...

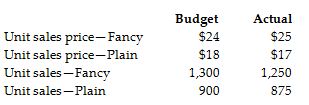

Top Half produces and sells two types of t-shirts—Fancy and Plain. The company provides the following data:

Compute the flexible budget variance for Fancy t-shirts for sales revenue.

When you do something that does not feel right, you violate the values of others

Indicate whether the statement is true or false

Ira Roth opens up a Roth IRA and places $5,000 in his retirement account at the beginning of

each year for 25 years. He believes the account will earn 9 percent interest per year, compounded monthly. How much will he have in his retirement account in 25 years? A) $490,000.58 B) $490,165.32 C) $355,900.96 D) $390,000.58

A(n) ____________________ is an observation that is unusually small or large

Fill in the blank(s) with correct word