In an earlier chapter we learned that a risk neutral person would be indifferent to a gamble that involved a coin flip with a $1,000 win if heads and a $1,000 loss if tails. In this chapter that conclusion is qualified. What changes does this chapter introduce that make the earlier conclusion altered?

What will be an ideal response?

Because of an asymmetric value function the person would value the win less than the loss so the expected utility would be negative in the deal. Therefore the dollars won must exceed the dollars lost before a risk neutral person will accept a gamble.

You might also like to view...

In a perfectly competitive market, many firms sell an identical product

Indicate whether the statement is true or false

The process of asset transformation refers to the conversion of

A) safer assets into risky assets. B) safer assets into safer liabilities. C) risky assets into safer assets. D) risky assets into risky liabilities.

Deficit spending results whenever the government

A. Uses borrowed funds to finance expenditures that exceed tax revenue. B. Issues bonds to finance the debt. C. Refinances the debt. D. None of the choices are correct.

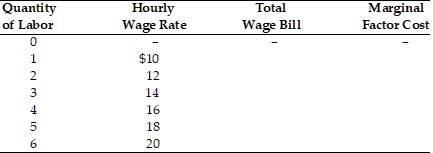

In the above table, if the marginal revenue product is $18, how many workers will the profit maximizing monopsonist hire and what wage will they pay each worker?

In the above table, if the marginal revenue product is $18, how many workers will the profit maximizing monopsonist hire and what wage will they pay each worker?

A. 3; $18 B. 5; $18 C. 4; $16 D. 3; $14