The major sources of funds for the U.S. Federal government include the following, except:

A. Payroll taxes

B. Proprietary income

C. Borrowing

D. General sales taxes

D. General sales taxes

You might also like to view...

The local pizza delivery industry currently has a Herfindahl-Hirschman index (HHI) value of 999 and two of the competing pizza shops have considered merging

Because the merger would raise the HHI by 55 points, the Federal Trade Commission would likely A) not challenge the merger. B) challenge the merger. C) allow the merger under the condition that HHI does not rise by more than 55 points as promised. D) allow the merger under the condition that the HHI remain at the premerger level of 999.

An individual in the England wants to buy office equipment from England which costs $2,000 . If the exchange rate is 1pound=$1.9, how much will the office equipment cost him in pounds?

a. 2,000 pounds b. 1,800 pounds c. 3,800 pounds d. 1,053 pounds

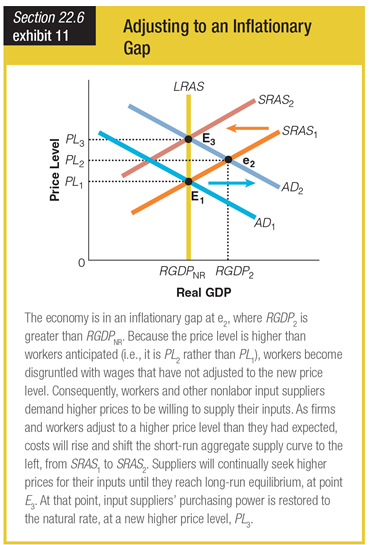

Which of the following statements describes how the economy returns to long-run equilibrium following the inflationary gap?

a. Rising input prices facilitate a shift from SRAS1 to SRAS2.

b. Actual real output increases from RGDPNR to RGDP2.

c. A temporary positive shock shifts LRAS rightward.

d. Rising demand facilitates a shift from AD1 to AD2.

Under the current federal income tax laws, a person who has a high income is likely to

A. receive a substantial benefit from the earned income tax credit. B. spend a larger fraction of total income than a low-income taxpayer. C. pay a larger percentage of income in taxes than the average taxpayer. D. pay a smaller percentage of income in taxes than the average taxpayer.