Business conduct that may not quite reach the level of prohibition under either the Sherman or the Clayton Act may be actionable under the "unfair" competition language of the FTCA

Indicate whether the statement is true or false

TRUE

You might also like to view...

Research shows that consumer socialization with respect to brand preferences begin at

A. the age of eighteen when they become college students, living outside their parents' home for the first time and being responsible for their purchase decisions. B. the age of two. C. the age of five when their cognitive skills have developed to understand the concept of money. D. the age of thirteen when they become teenagers, when they can understand the responsibility involved in saving money to be able to consume products and services. E. at any time, though most people change their brand preferences many times during their lifetimes.

Infographic résumés focus on:

A) experience related to computer software that generates graphics. B) the geographical area of the job search. C) presenting the contents of a résumés in the form of graphics. D) experience in information graphic software.

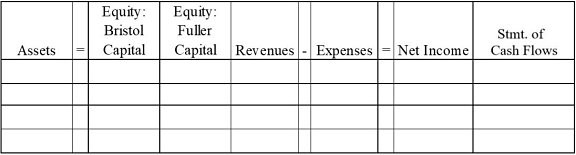

The Bristol-Fuller partnership was formed on January 1, Year 1, when Bristol and Fuller invested $40,000 and $30,000 cash in the partnership, respectively. During Year 1, the partnership earned $75,000 in cash revenues and paid $52,000 in cash expenses. Bristol withdrew $5,000 cash from the business during the year, and Fuller withdrew $4,000. The partnership agreement specified that net income should be allocated equally to the partners' capital accounts. Required:Indicate how each of the transactions and events for the Bristol partnership affects the financial statements model, below. Indicate dollar amounts of increases and decreases. With regards to the statement of cash flows, indicate whether each is an operating activity (OA), investing activity (IA), or financing activity (FA).

Indicate NA if an element is not affected by a transaction.

What will be an ideal response?

Bramble Corporation is a small wholesaler of gourmet food products. Data regarding the store's operations follow:•Sales are budgeted at $340,000 for November, $320,000 for December, and $310,000 for January. •Collections are expected to be 80% in the month of sale and 20% in the month following the sale. •The cost of goods sold is 75% of sales. •The company would like to maintain ending merchandise inventories equal to 60% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase. •Other monthly expenses to be paid in cash are $24,000. •Monthly depreciation is $15,000. •Ignore taxes. Balance SheetOctober 31Assets Cash$20,000Accounts receivable 70,000Merchandise inventory 153,000Property, plant and equipment,

net of $572,000 accumulated depreciation 1,094,000Total assets$ 1,337,000 Liabilities and Stockholders' Equity Accounts payable$254,000Common stock 820,000Retained earnings 263,000Total liabilities and stockholders' equity$ 1,337,000The cost of December merchandise purchases would be: A. $255,000 B. $240,000 C. $139,500 D. $235,500