Suppose a 25-year-old worker purchases a $5,000 bond that pays 6% interest per year which she plans to withdraw when she retires in 40 years. How much will the $5,000 accumulate to in 40 years? If the worker faces a marginal tax rate of 30% on interest income, how much will the $5,000 accumulate to in 40 years?

In the absence of taxes, the bond will accumulate to $51,428.59 . With a marginal tax rate of 30% on her interest income, the bond will accumulate to $25,922.61.

You might also like to view...

Economies of scale arise from:

A. decreasing returns to scale. B. increasing returns to scale. C. constant returns to scale. D. constant marginal returns to scale.

For a constrained minimization problem, the decision maker

A. is constrained by the choice set of values for the activities. B. seeks to minimize the cost of achieving a specific goal. C. is constrained by the specific amount of total benefits. D. all of the above E. none of the above

The short-run aggregate supply curve would shift and the long-run aggregate supply curve would remain fixed if

A. there was a temporary shock that influenced the supply side. B. there was a permanent increase in aggregate demand. C. there was a temporary shock to aggregate demand. D. there was a permanent increase in aggregate demand along with a permanent decrease in aggregate supply.

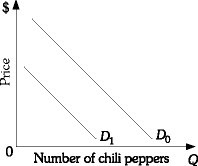

Refer to the information provided in Figure 3.5 below to answer the question(s) that follow. Figure 3.5Refer to Figure 3.5. If consumer income increases, the demand for chili peppers shifts from D0 to D1. This implies that chili peppers are a(n)

Figure 3.5Refer to Figure 3.5. If consumer income increases, the demand for chili peppers shifts from D0 to D1. This implies that chili peppers are a(n)

A. inferior good. B. substitute good. C. complementary good. D. normal good.