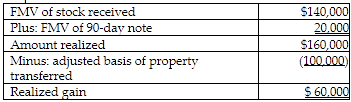

Jeremy transfers Sec. 351 property acquired three years earlier having a $100,000 basis and a $160,000 FMV to Jeneva Corporation. Jeremy receives all 200 shares of Jeneva stock having a $140,000 FMV, and a $20,000 90-day Jeneva note. What is Jeremy's recognized gain?

A) $0

B) $60,000

C) $20,000

D) $160,000

C) $20,000

Jeremy's recognized gain is the lesser of the realized gain or the FMV of the 90-day note (boot property).

You might also like to view...

Which of the following describes a literal patent infringement where the infringed device does more than is described in the patent application of the protected invention?

A. rule of addition B. rule of exactness C. rule of inclusion D. rule of omission

Which of these actions is applicable under the Uniform Gifts to Minors Act?

A. Gifts of registered securities can be made by merely delivering the securities to a bank trustee. B. Adults can make a gift of money to minors by depositing the money with a bank in an account in the donor's name. C. Adults are prohibited from making gifts of unregistered securities to minors. D. Gifts of unregistered securities can be made by registering the securities in the name of another adult.

Which of the following is a unique feature of demand-based pricing?

A) The demand-based pricing curve nears the unit cost curve at the end of the life cycle. B) Demand-based pricing is effective for companies with an effective monopoly in their respective industries. C) Demand-based pricing can be volatile as fickle customers change their demand for the product or service. D) The prices at the decline stage are generally higher than those at any other stage in the product life cycle.

The following account balances were taken from the adjusted trial balance of Kendall Company: Revenues$23,900?Operating Expenses 15,500?Dividends 5000?Retained Earnings 17,500?What is the Retained Earnings account balance that will be included on the post-closing trial balance

A. $20,900. B. $3400. C. $8400. D. $25,900.