As a result of the financial crisis, checkable deposits:

A) became a smaller portion of overall liabilities

B) experienced little change

C) hit a new record high in terms of the percent of liabilities

D) nearly doubled in terms of the percent of liabilities

D

You might also like to view...

If you were a professor of economics explaining to your class the three primary tools of monetary policy used by the Fed, you would write on the chalk board

a. changes in the legal reserve requirement, changes in the discount rate, and changes in tax rates b. changes in the legal reserve requirement, changes in tax rates, and open market operations c. changes in tax rates, changes in the discount rate, and open market operations d. changes in the legal reserve requirement, open market operations, and moral suasion e. changes in the legal reserve requirement, changes in the discount rate, and open market operations

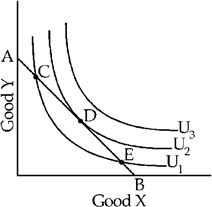

Figure 5-13

In Figure 5-13, the consumer can afford any combination of X and Y represented by a point

a.

on line AB only.

b.

on or below line AB.

c.

on or above line AB.

d.

anywhere on the graph.

If the Federal Reserve wished to engage in contractionary monetary policy, it could

A. lower the primary credit rate. B. raise the Federal Funds rate target. C. purchase government debt. D. lower the reserve ratio.

An inflationary expenditure gap is the amount by which:

A. equilibrium GDP falls short of the full-employment GDP. B. aggregate expenditures exceed any given level of GDP. C. saving exceeds investment at the full-employment GDP. D. aggregate expenditures exceed the full-employment level of GDP.