Your drink budget is entirely split between bottled water and fancy liqueurs, and your tastes are quasilinear in bottled water. In an attempt to get people to drink more water, the government introduces a subsidy that lowers the price of bottled water.

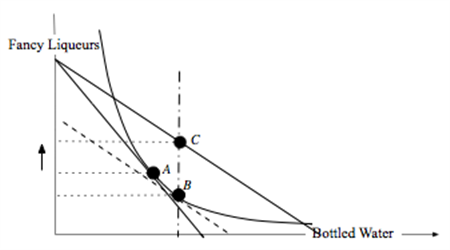

a. In a graph with bottled water on the horizontal and fancy liqueurs on the vertical axis, illustrate your before-subsidy budget and your optimal bundle A.

b. As a result of the water subsidy, I notice you consume more fancy liqueur. Illustrate this in your graph using income and substitution effects.

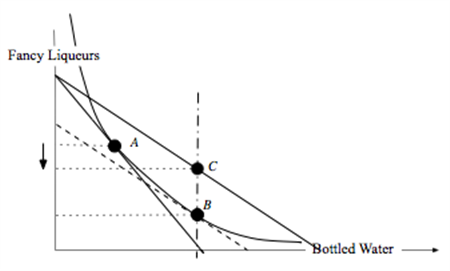

c. You and I are good friends, in part because I confided in you some time ago that I, too, have tastes that are quasilinear in water. (Nothing bonds like quasilinearity!) But, after the subsidy is introduced, you observe that I, unlike you, have reduced my consumption of fancy liqueurs. Your other friends claim that this is proof that our friendship is based on a fiction --- that I cannot possibly also have quasilinear tastes. Illustrate in a graph why your friends are wrong.

d. If we both have quasilinear tastes, can you explain what the fundamental difference in our tastes is that accounts for the difference in behavior?

What will be an ideal response?

b. The substitution effect takes you from A to B, and the income effect takes you vertically up to C (from B) because of the quasilinearity of bottled water. Since C is higher than A, we have illustrated the case of you consuming more liqueurs as a result of the lower price for bottled water.

c. Below we illustrate the same graph as above except that the substitution effect is bigger. As a result, C ends up below A --- illustrating a case where bottled water is still quasilinear but my consumption of liqueurs falls when the price of bottled water falls.

d. The fundamental difference in our tastes is the degree of substitutability of water for liqueur at the original bundle A. The two are relatively complementary for you --- resulting in a small substitution effect, while they are relatively substitutable for me, resulting in larger substitution effect.

You might also like to view...

Credit risk reflects:

a. A company's expected performance, level of solvency, and potential inability to service its debts. b. A company's ability to get "credit for its performance" in the stock market, which means having its share price rise at the same rate or faster than profitability. c. The variability of cash flows for the national government. d. All of the above.

Suppose that the government taxes income in the following fashion: 20 percent of the first $50,000 . 40 percent of the next $50,000 . and 60 percent of all income over $100,000 . Marshall earns $200,000 . and Lily earns $600,000 . Which of the following statements is correct?

a. Marshall's marginal tax rate is higher than Lily's marginal tax rate. b. Marshall's average tax rate is higher than his marginal tax rate. c. Lily's average tax rate is higher than her marginal tax rate. d. Lily's average tax rate is higher than Marshall's average tax rate.

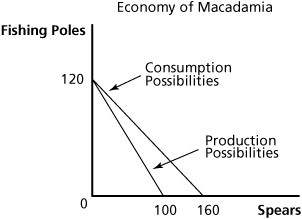

Figure 18.2Refer to Figure 18.2. After trade and specialization begin, the maximum amount of fishing poles that Macadamia can consume is:

Figure 18.2Refer to Figure 18.2. After trade and specialization begin, the maximum amount of fishing poles that Macadamia can consume is:

A. 40. B. 100. C. 120. D. 160.

When the consumer spends a large portion of her income on a good, demand will be

A) elastic. B) unit-elastic. C) inelastic. D) elastic, unit-elastic or inelastic depending upon supply.