A production company is studying the relationship between the average cost/unit and number of units produced in a batch. A sample of 10 batches is selected and the data is given below.

?

No. of units produced Cost/unit 2037.7158 3535.0158 5030.8158 6525.8158 8020.0364 9516.9064 11016.3766 12013.8564 13513.9696 150 13.847a. Develop a scatter chart for these data. What does the scatter chart indicate about the relationship between average cost/unit and number of units produced?b. Regardless of your answer to part (a), develop an estimated simple linear regression equation for the data. How much variation in the sample values of cost/unit is explained by this regression model?

What will be an ideal response?

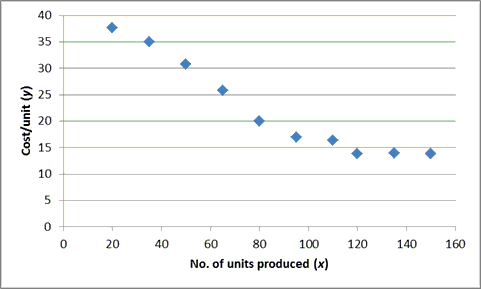

a. The scatter chart with number of units produced as the independent variable follows.

A simple linear regression model does not appear to be appropriate; there appears to be a nonlinear relationship between cost/unit and number of units produced in a batch.

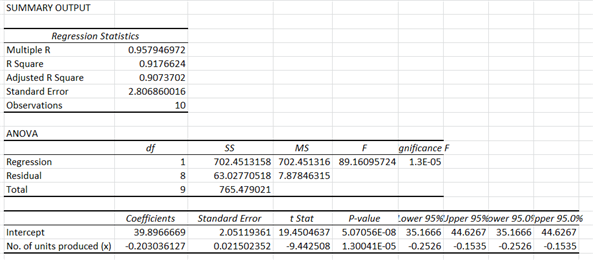

b. The following Excel output provides the estimated simple linear regression equation that could be used to predict cost/unit (y) given the number of units produced in a batch (x).

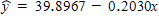

The estimated multiple linear regression equation is

You might also like to view...

The key to buzz marketing is letting consumers enjoy the benefit of a good or service before actually making a purchase

Indicate whether the statement is true or false

According to Mead, the self ______.

a. only changes as a result of us wanting it to change b. can only be perceived from within c. disregards others’ judgments of us d. involves both an “I” and a “me”

On January 1, 2017, Apex Solutions paid $200,000 to acquire Fancy Phones Company, an electronic gadget-advertising website. At the time of the acquisition, Fancy Phones' balance sheet reported total assets of $200,000 and liabilities of $100,000. The fair market value of Fancy Phones' assets was $200,000. The fair market value of its liabilities was $100,000. At the end of 2020, goodwill was measured, and its fair value was determined to be $60,000. Record the impairment of goodwill. Omit explanation.

What will be an ideal response?

A company has two divisions, A and B; each are operated as a profit center. A charges B $35 per unit for each unit transferred to B. Other data follow: A's variable cost per unit $30 A's fixed costs $10,000 A's annual sales to B 5,000 units A's annual sales to outsiders 50,000 units A is planning to raise its transfer price to $50 per unit. Division B can purchase units at $40 each from

outsiders, but doing so would idle A's facilities now committed to producing units for B. Division A cannot increase its sales to outsiders. From the perspective of the company as a whole, from whom should Division B acquire the units, assuming B's market is unaffected? a. outside vendors b. Division A, but only at the variable cost per unit c. Division A, but only until fixed costs are covered, then should purchase from outside vendors d. Division A, in spite of the increased transfer price