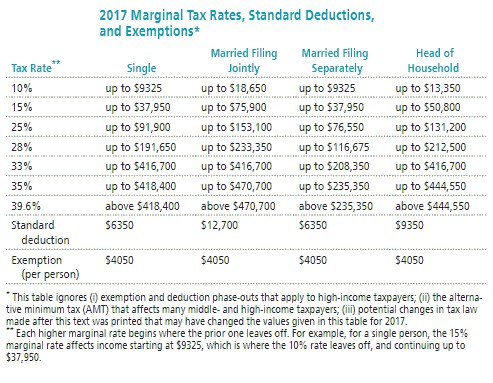

Solve the problem. Refer to the table if necessary. Jim earned wages of

Jim earned wages of  received

received  in interest from a savings account, and contributed

in interest from a savings account, and contributed  to a tax deferred retirement plan. He was entitled to a personal exemption of

to a tax deferred retirement plan. He was entitled to a personal exemption of

style="vertical-align: -4.0px;" /> and had deductions totaling  Find his adjusted gross income.

Find his adjusted gross income.

A. $93,729

B. $97,779

C. $84,561

D. $110,613

Answer: B

You might also like to view...

Provide an appropriate response.What value of K makes this equation equivalent to x = 3?7x - 6 = K

Fill in the blank(s) with the appropriate word(s).

Solve the problem.If tan ? =  , and ? terminates in quadrant III, then find cos 2?.

, and ? terminates in quadrant III, then find cos 2?.

A.

B.

C. -

D. -

Solve the problem.You need a $120,690 loan. Compute the monthly payment for each of the loan options listed below. Assume that the loans are fixed rate.Option 1: a 30 year-loan at an APR of 7.15%Option 2: a 15-year loan at 6.75%

A. Option 1: $832.96 Option 2: $1116.40 B. Option 1: $803.13 Option 2: $1035.62 C. Option 1: $829.12 Option 2: $1104.52 D. Option 1: $815.15 Option 2: $1068.00

Decide whether the statement makes sense. Explain your reasoning.We will never be able to send our daughter to college. In order to have $100,000 in 20 years we would have to save at least $500 each month, That's more than we can afford.

What will be an ideal response?