The more elastic the demand for a good,

a. the more of an excise tax is that is collected by sellers

b. the more of an excise tax that is paid by buyers

c. the more an excise that is paid by sellers

d. the more elastic the supply of that good

e. the smaller the burden of a tax on that good

C

You might also like to view...

Suppose a consumer only consumes goods x and y, and suppose that x is a normal good while y is an inferior good. Which of the following is might be true?

A. The cross-price elasticity of demand for x is positive. B. The cross-price elasticity of demand for x is negative. C. The own-price elasticity of demand for y is positive. D. The own-price elasticity of demand for y is negative. E. Both (a) and (c). F. Both (b) and (d). G. All of the above. H. None of the above.

Between 1780 and 1805, five Northern states enacted emancipation laws. All of the following statements characterize these laws except:

a. The emancipation laws provided for freedom of newborn babies when they reached adulthood. b. The emancipation laws allowed owners to avoid freeing slaves by selling them to Southerners. c. The emancipation laws provided for government agencies that assisted newly-freed slaves. d. The emancipation laws indirectly compensated owners for the losses incurred by freeing slaves.

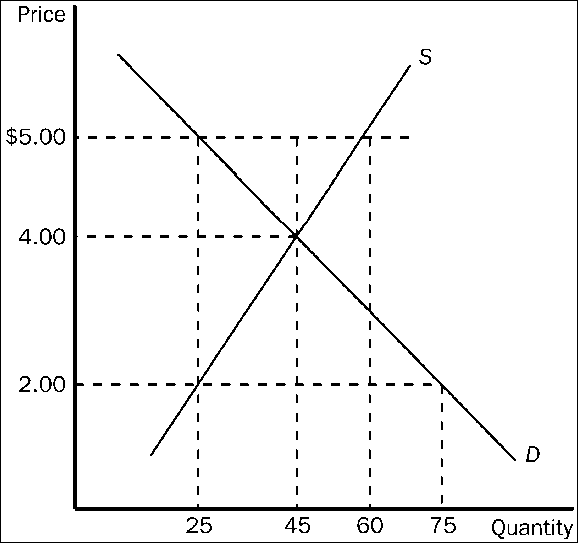

Figure 4-18

Refer to . If the government imposes a price ceiling of $2.00 in this market, the result is a

a.

surplus of 30 units of the good.

b.

shortage of 20 units of the good.

c.

shortage of 30 units of the good.

d.

shortage of 50 units of the good.

Hourly wages and fringe benefits average about _______ an hour in Mexico.

Fill in the blank(s) with the appropriate word(s).