The government sometimes provides public goods because

a. private markets would not produce any of the goods.

b. private markets would not produce the efficient quantity of the goods.

c. private markets would charge too high a price for the goods.

d. the government produces public goods more efficiently than private markets can.

B

You might also like to view...

Implicit costs are ________ and explicit costs are ________

A) costs that involve spending money; also costs that involve spending money B) nonmonetary costs; costs that involve spending money C) costs that involve spending money; nonmonetary costs D) nonmonetary costs; also nonmonetary costs

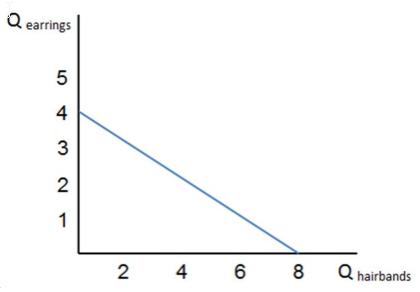

Assume the graph shown represents Grace's budget constraint. Which of the following is true?

A. Grace's total utility is constant along her budget constraint.

B. Grace's marginal utility of each good is the same for each combination of goods on her budget line.

C. Grace's total expenditure is constant along her budget constraint.

D. Grace is indifferent between consuming any bundle that lies on the budget constraint.

The marginal revenue product is the extra revenue the firm receives by selling one additional unit of output.

Answer the following statement true (T) or false (F)

Just before and during the recession of 2007-2009, net exports in the United States

A) fell and remained negative. B) fell, but remained positive. C) rose and became positive. D) rose, but remained negative.