Meega airlines decided to offer direct service from Akron to Clearwater Beach, Florida. Management must decide between full-price service using a company's new fleet of jet aircraft and a discount-service using smaller capacity commuter planes. Management developed estimates of the contribution to profit for each type of service based upon two possible levels of demand for service on Clearwater Beach: high, moderate, and low. The following table shows the estimated quarterly profits (in thousands of dollars):

?

Demand for service

ServiceHighMediumLowFull Price900760-430Discount710650350?

a. If the demand probabilities are 0.3, 0.5, and 0.2, what is the best decision using the expected value approach?

b. Construct a risk profile for the optimal decision in part a. What is the probability of the profit exceeding $700,000?

?

What will be an ideal response?

a. EV(Full) = 0.3(900) + 0.5(760) + 0.2(-430) = 564 or $564,000

EV(Discount) = 0.3(710) + 0.5(650) + 0.2(350) = 608 or $608,000

Optimal Decision: Discount service

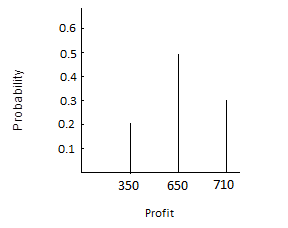

b. The risk profile is shown in tabular form. The probability that the cost exceeds $700,000 is 0.3.

Profit | Probability |

$350 | 0.2 |

$650 | 0.5 |

$710 | 0.3 |

You might also like to view...

Under the objective rule, the person who was given the engagement ring must return the ring, regardless of which party broke off the engagement

Indicate whether the statement is true or false

The advantages of _________________ may include increased efficiency and more accurate production as single workers become more skilled in the one particular task that is assigned.

a. Departmentalization b. Span of control c. Formalization d. Specialization

Rico Paving Contractors enters into a contract with Valley Supply for the purchase of 100 bags of cement per week for the next 16 weeks, at a price of $15 per bag. The contract also includes a condition that allows prices to be revised if costs go up more than $1 per bag. This purchase involves

A. cost reimbursement contracting. B. an indefinite delivery contract. C. a good faith purchase. D. negotiated contract buying. E. price allocation purchasing.

What are the dominant factors that a manufacturing firm must consider when making a location decision?

What will be an ideal response?