What monetary policy is recommended by Milton Friedman and other monetarists? Why?

What will be an ideal response?

Friedman recommends that the money supply be increased at a rate of 3 to 5 percent annually, regardless of the condition of the economy. This monetary rule, monetarists believe, would stabilize economic activity and the price level more successfully than does the current changing policies of the Fed. Friedman argues that the lag between the implementation of changes by the Fed and their impact on the money supply is much longer than the Fed anticipates. The impact often occurs after the economy is no longer in the condition that the Fed was attempting to correct. As a result, he argues, the Fed aggravates fluctuations in economic activity and the price level.

You might also like to view...

Adrienne and Jacob talk about the 2008 financial crisis and the US Government's response to the troubles. So,

What will be an ideal response?What will be an ideal response?

Shifts in aggregate demand affect the price level in

a. the short run but not in the long run. b. the long run but not in the short run. c. both the short and long run. d. neither the short nor long run.

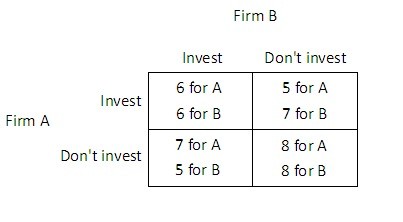

Suppose Firm A and Firm B are considering whether to invest in a new production technology. For each firm, the payoff to investing (given in thousands of dollars per day) depends upon whether the other firm invests, as shown in the payoff matrix below.  Is this game a prisoner's dilemma?

Is this game a prisoner's dilemma?

A. No. B. Yes. C. It cannot be determined. D. Only when both Firm A and Firm B invest.

Suppose the economy is initially experiencing a recessionary gap. An increase in the size of the budget deficit will

A. increase the size of the recessionary gap. B. lead to an increase in prices with no increase in real GDP. C. lead to a decrease in prices with an increase in real GDP. D. reduce the size of the recessionary gap.