The term tax incidence refers to how the burden of a tax is distributed among the various people who make up the economy

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

Information in a firm's financial statements

A) assists investors who are considering buying the firm's stock. B) helps the firm's managers make decisions. C) guide resource allocation in the economy. D) all of the above

For diversification to be a successful management strategy, it must

A) generate accounting profits. B) earn normal profits. C) protect market share. D) add value.

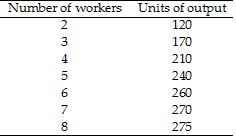

Refer to Table 10.2. If the price of output is $2 per unit and the wage rate is $40, how many workers should be hired?

Refer to Table 10.2. If the price of output is $2 per unit and the wage rate is $40, how many workers should be hired?

A. six workers B. five workers C. four workers D. three workers

At the Amarillo Piano Company, the average product of labor stays constant at 5, regardless of how much labor is employed. This implies that:

A. There are no fixed costs B. This firm can never maximize its profits C. The marginal product of labor is constant D. Labor exhibits diminishing marginal returns