Assume that banks lend out all their excess reserves. Currently, the legal reserves that banks must hold equal $11.5 billion. If the Federal Reserve decreases its reserve requirement from 10 percent to 5 percent, then there is potential for the whole banking system to raise the money supply by:

a. $11.5 billion.

b. $230 billion.

c. $115 billion.

d. $57.5 billion.

e. $575 billion.

c

You might also like to view...

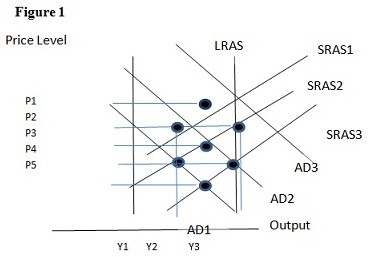

Refer to the above figure. Suppose that the economy starts at AD1. If the government reduces taxes, then the economy goes to AD2, but then falls back to AD3. This is an example of

A) complete crowding-out effect. B) partial crowding-out effect. C) Ricardian equivalence. D) laissez-faire.

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the short run would be:

A. P1 and Y2. B. P3 and Y1. C. P2 and Y2. D. P2 and Y3.

Pareto improvements occur

a. through the tax system b. rarely in the real world c. when the economy has reached the point of economic efficiency d. when market exchanges take place e. when consumers are not perfectly informed

How does the relationship between saving and intended investment affect the economy?