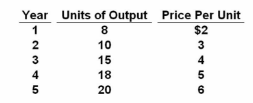

Answer the question based on the following price and output data over a five-year period for an economy that produces only one good. Assume that year 2 is the base year.

Refer to the above data. If year 2 is the base year, the price index for year 3 is:

A.

120

B.

125

C.

133

D.

150

C.

133

You might also like to view...

Suppose a retail store was offering 10% off list prices on all goods. The benefit of the 10% savings is:

A. unrelated to the list price of the good. B. zero since costs and benefits shouldn't be measured proportionally. C. positively related to the list price of the good. D. negatively related to the list price of the good.

Steven lives in a big city where there is a shortage of parking. He has a parking spot in his driveway where he parks his car. Which of the following statements is most correct?

A) The opportunity cost of using the spot is zero, because Steven owns the house. B) Steven has a lower opportunity cost of owning a car than his neighbor, who must rent a parking spot. C) The opportunity cost of using the parking spot is the price he could charge someone else for using the spot. D) The opportunity cost depends on how much Steven's mortgage payment is.

When Gabriel made a rational choice to spend his entire allowance on candy bars, he did so by comparing the

A) benefits of the candy bars to the desires he had for the candy bars. B) marginal benefits of the candy bars to the marginal costs of the candy bars. C) opportunity costs of the candy bars to the scarcity of the candy bars. D) benefits of the candy bars to the scarcity candy bars. E) self-interest to the social interest.

Would a profit-maximizing firm continue to operate if the price in the market fell below its average cost of production in the short run?

What will be an ideal response?