A unit tax placed on demanders causes the supply curve to shift downward, shifting part of the tax burden to supplier in the form of lower prices and quantity

a. True b. False

b

You might also like to view...

If the MPC equals 0.75, then

A) for every $100 increase in consumption, real Gross Domestic Product (GDP) increases by $75. B) for every $100 increase in real Gross Domestic Product (GDP), saving increases by $25. C) consumption is always more than real Gross Domestic Product (GDP). D) for every $100 increase in real Gross Domestic Product (GDP), saving increases by $75.

When the government reduces its restrictions on immigration,

a. the prices of goods rise because the demand for goods increases b. immigration is reduced c. labor mobility is reduced d. wage differentials become narrower e. all workers are better off

A rise in real income will have which of the following effects on money demand?

a. The money demand curve will shift out. b. The money demand curve will not shift at all. c. The money demand curve will shift in. d. Real income has no effect on money demand.

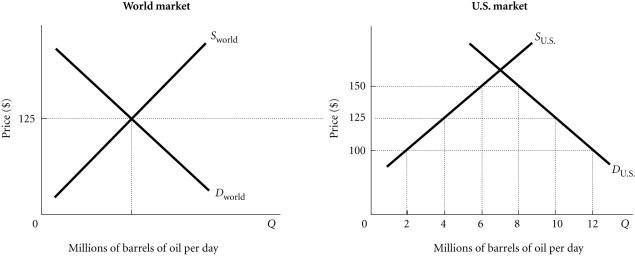

Refer to the information provided in Figure 4.4 below to answer the question(s) that follow. Figure 4.4Refer to Figure 4.4. The price of oil in the United States would be $125 per barrel, and the United States would import 6 million barrels of oil per day if the United States levies ________ per barrel tariff on imported oil.

Figure 4.4Refer to Figure 4.4. The price of oil in the United States would be $125 per barrel, and the United States would import 6 million barrels of oil per day if the United States levies ________ per barrel tariff on imported oil.

A. no B. a $25 C. a $50 D. a $100