The government wishes to close an inflationary gap by reducing real GDP by $400 billion. Assuming a tax multiplier of 4 and an income multiplier of 5, which of the following policy prescriptions would reduce the inflationary gap by $400 billion?

a. Decreasing government spending by $400 billion and increasing taxes by $400 billion.

b. Decreasing government spending by $160 billion and decreasing taxes by $100 billion.

c. Decreasing government spending by $40 billion and decreasing taxes by $40 billion.

d. Decreasing government spending by $80 billion and keeping taxes the same.

e. Doing absolutely nothing to the economy.

b

You might also like to view...

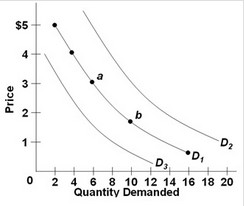

Use the following graph of the demand for electric cars to answer the question below. Which of the following would occur if electric cars became less expensive?

Which of the following would occur if electric cars became less expensive?

A. D3 to D1 B. Point a to point b C. Point b to point A D. D2 to D1

Interest rates will increase if the Fed conducts an open market purchase

Indicate whether the statement is true or false

Two goods with a low cross elasticity of demand are competing in the same market.

Answer the following statement true (T) or false (F)

In an oligopoly, following a rival’s decrease in price tends to eliminate the

a. income effect. b. substitution effect. c. multiplier effect. d. random effect.