A regressive tax structure is one:

a. in which the tax rate increases as the base increases

b. in which the tax rate remains the same as the base increases.

c. that tends to discourage additional work as income rises.

d. that is famous and in use in the U.S.

e. in which the tax rate increases as the base increases.

e

You might also like to view...

The real cost of a decision is the opportunity cost measured in the commodities forgone.

Answer the following statement true (T) or false (F)

Securities dealers that trade stocks and bonds outside exchanges comprise the

A) NASDAQ market. B) outlet market. C) foreign exchange market. D) over-the-counter market.

Self-indulgence and non-deferred gratification have convinced some that poor lack the desire and motivation to escape poverty

Indicate whether the statement is true or false

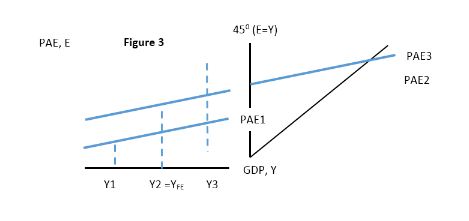

Using Figure 3 below, suppose that the economy was at Y3. This level of GDP would be considered:

A. inflationary.

B. recessionary.

C. a long run level of output.

D. a natural rate of output.