A progressive tax is such that:

A. tax rates are higher the greater one's income.

B. the same tax rate applies to all income receivers, so that the rich pay absolutely more

taxes than the poor.

C. entrepreneurial income is exempt from taxation.

D. the revenues it yields are spent on transfer payments.

Answer: A

You might also like to view...

Public choice deals exclusively with business decisions

Indicate whether the statement is true or false

Compared to the no-trade situation, when a country imports a good, which of the following will occur?

What will be an ideal response?

The economy moves down a stationary aggregate demand curve when the Fed:

A. increases its target inflation rate, reflected by a downward shift in the Fed's policy reaction function. B. decreases real interest rates in response to inflation, but does not change its target inflation rate or the Fed's policy reaction function. C. increases real interest rates in response to inflation, but does not change its target inflation rate or the Fed's policy reaction function. D. decreases its target inflation rate, reflected by an upward shift in the Fed's policy reaction function.

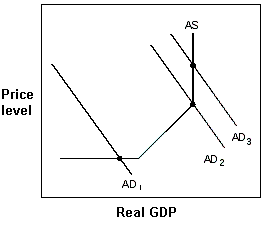

Exhibit 15-6 Aggregate demand and supply model

?

A. raise taxes to move to AD1. B. not change its policy. C. cut taxes to move to AD3. D. cut spending to move to AD3.