What are the strengths and weaknesses of the negative income tax (NIT) as an alternative to traditional welfare programs?

The tax would increase the incentive to earn, since one's income would always rise if earnings increased. Traditional welfare programs effectively tax away very high percentages of additional earnings by reducing payments substantially. The down side of the NIT is that incomes considerably above the poverty level would still receive money, so that the overall program could be costly.

You might also like to view...

Average physical product measures the output per unit of input.

Answer the following statement true (T) or false (F)

Economists object to monopolies on the grounds of efficiency. Why is this? Explain.

What will be an ideal response?

A pay cap, acting as a price ceiling, for superintendent pay would do what in the labor market?

A. Decrease the supply of superintendents. B. Cause a shortage of superintendents. C. Increase the demand of superintendents. D. Cause a surplus of superintendents.

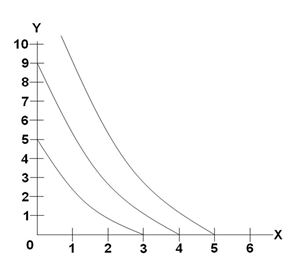

Refer to the graph below. Suppose you had tastes as described by the indifference curves above. If your income was $100, Px = 20 and Py = 25, which combination of X and Y would maximize your utility?

A. 5X and 0Y

B. 0X and 4Y

C. 3X and 1Y

D. 5X and 4Y