In 2016, Microsoft will pay corporate income tax to the federal government based on the company's __________________.

A. corporate profits

B. excise profits

C. optional tax rate

D. proportional tax rate

Ans: A. corporate profits

You might also like to view...

The value of a human life

A. can be estimated by potential future earnings. B. can be subjected to cost-benefit analysis. C. is an intangible that is hard to price. D. all of these answer options are correct.

When externalities cause markets to be inefficient,

a. government action is always needed to solve the problem. b. private solutions can be developed to solve the problem. c. given enough time, externalities can be solved through normal market adjustments. d. there is no way to eliminate the problem of externalities in a market.

When a firm's average total cost curve continually declines, the firm is a

a. government-created monopoly. b. natural monopoly. c. revenue monopoly. d. All of the above are correct.

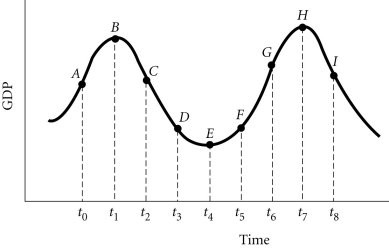

Refer to the information provided in Figure 29.1 below to answer the question(s) that follow. Figure 29.1Refer to Figure 29.1. If policy makers take an action at time t2, the impact on the economy will not be at time t2 because

Figure 29.1Refer to Figure 29.1. If policy makers take an action at time t2, the impact on the economy will not be at time t2 because

A. of the response lag. B. economic policies are ineffective. C. of the recognition lag. D. of the implementation lag.