Suppose you own a plum (high-quality) used car that you are thinking about selling. Further, suppose you know that buyers assume that there is a 30% chance of getting a plum, and that 8 of 10 cars currently in the used car market are lemons (low-quality). Would you likely sell your car?

What will be an ideal response?

You are more likely to do so than you typically would. Since buyers overestimate the probability of getting a plum, you know that you can get a better price than you normally would by entering the market.

You might also like to view...

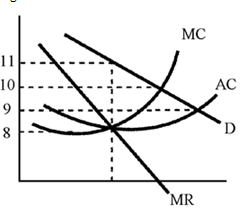

Figure 11-9

A. $1 B. $2 C. $3 D. $11

During the Great Depression, the actual unemployment rate in the U.S. ________, and the natural rate apparently ________

A) increased; decreased B) increased; remain unchanged C) increased; increased as well D) decreased; increased E) decreased; remained unchanged

For a monopolistically competitive market, the number of firms in the market implies that

A. each firm faces a perfectly elastic demand. B. all firms will make losses. C. firms will collude to set monopoly price and output. D. each firm acts independently of other firms.

In the United States, higher income households face ________ marginal tax rates, and therefore have ________ incentives to seek deductions of various sorts.

A. lower; fewer B. higher; more C. higher; fewer D. lower; more