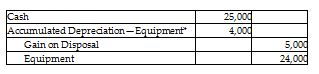

Equipment was purchased for $24,000 on January 1, 2018. The equipment's estimated useful life was five years, and its residual value was $4,000. The straight-line method of depreciation was used. Prepare the journal entry to record the sale of the equipment for $25,000 on January 3, 2019. The company has a calendar year accounting period. Omit explanation.

What will be an ideal response?

*Accumulated Depreciation: Asset was held for 1 year

Annual Depreciation: (Cost - residual value) / useful life

($24,000 - $4,000) / 5 years = $4,000

You might also like to view...

If an employee is hired and causes injury to another, the employer may be guilty of ________

Fill in the blanks with correct word

A partnership may exist:

A) For a fixed term. B) For a set time period. C) Until some event occurs. D) All of the above.

The fact the services cannot be inventoried and then sold at a later date is called

A. intangibility. B. heterogeneity. C. inseparability. D. perishability. E. nonstorability.

Which of the following can take proactive to approach to responsibility in the tourism and hospitality industry?

a. Firms b. Hotels c. Events d. All of the above