Assuming that Davis purchases 100% of Martin for $300,000, answer the following:

Davis Inc. purchased a controlling interest in Martin Inc. on January 1, 2015,

when Martin's common shares and retained earnings were carried at $180,000

and $60,000 respectively. On that date, Martin's book values approximated its

fair values, with the exception of the company's inventories and a Patent held by

Martin. The patent, which had an estimated remaining useful life of ten years,

had a fair value which was $20,000 higher than its book value. Martin's

Inventories on January 1, 2015 were estimated to have a fair value that was

$16,000 higher than their book value.

It was predicted that Martin's goodwill impairment test, which was to be

conducted on December 31, 2016, would result in a loss equal to 10% of the

goodwill (regardless of the amount) at the date of acquisition being recorded.

During 2015, Martin reported a net income of $60,000 and paid $12,000 in

dividends. Martin's 2016 net income and dividends were $72,000 and $15,000,

respectively. Martin uses straight-line amortization for all of its assets.

Required:

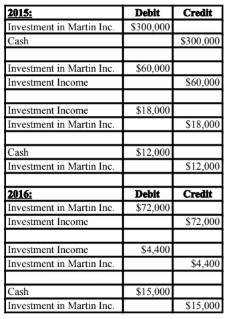

a) Prepare Davis' Equity Method journal entries for 2015 and 2016.

b) Compute the following as at December 31, 2016:

i. Investment in Martin Inc.

ii. Goodwill

iii. The amount of unamortized acquisition differential.

a) Equity Method Journal Entries

b)

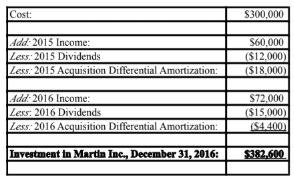

i) Investment in Martin Inc.:

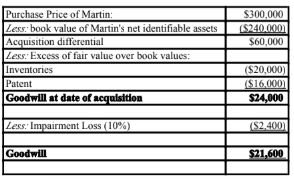

ii) Goodwill:

iii) The only unamortized acquisition differential remaining would be 8/10 of the excess fair value of the patent, which would be $16,000 plus the goodwill of $21,600 for a total of $37,600.

You might also like to view...

______ comprises high levels of stressors that have destructive and negative effects on effort and performance.

A. Distress B. Stress C. Eustress D. Strain

Define liability. When is it recognized?

Elaborate statistical analysis, in the form of ____________, is sometimes used to aid decisions on where to locate supermarkets and similar large stores relative to prospective customers' homes and workplaces

a. binary regression b. cluster analysis c. structural equation models d. gravity models e. predictive models

Describe the "what," "who," "when," and "where" concepts in terms of architectural view

What will be an ideal response?