The fund with the highest Sharpe measure is

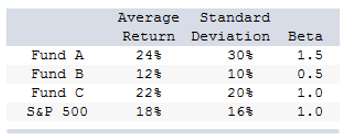

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation. The risk-free return during the sample period is 6%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.

A. Fund A.

B. Fund B.

C. Fund C.

D. Funds A and B (tied for highest).

E. Funds A and C (tied for highest).

C. Fund C.

A: (24% 6%)/30% = 0.60;

B: (12% 6%)/10% = 0.60;

C: (22% 6%)/20% = 0.80; S&P 500: (18% 6%)/16% = 0.75.

You might also like to view...

Ending inventory valued under the FIFO method will be the same regardless of whether the periodic system or the perpetual system is used

a. True b. False Indicate whether the statement is true or false

gross profit as a percentage of net sales is ________. (Round your answer to two decimal places.)

Mercer, Inc. provides the following data for 2019:

![]()

A) 37.96%

B) 39.80%

C) 60.20%

D) 40.8%

Heckart Corporation purchased plant assets for $120,000 cash. The journal entry to record the outflow of cash is:

a. Investments 120,000 Cash 120,000 b. Plant Assets 120,000 Cash 120,000 c. Plant Assets 120,000 Purchases 120,000 d. Purchases 120,000 Plant Assets 120,000

A voluntary reporting scheme for businesses that covers critical areas affecting the conduct of international business-human rights, labor, the environment, and anticorruption efforts is the _______________________.

What will be an ideal response?