Tyler Company incurred an inventory loss due to a decline in net realizable value (NRV) during its first quarter of operations in 20X8. At the end of the first quarter, management of the company believed the decline in NRV to be permanent. In the second quarter, the NRV of Tyler's inventories increased above their acquisition cost. NRV remained higher than acquisition cost during the remainder of 20X8. How should Tyler report the facts above on its first and second quarter income statements? First QuarterSecond QuarterA)Recognize inventory lossRecognize recovery of inventory lossB)Recognize inventory lossNo recognition of recovery of inventory lossC)No recognition of inventory lossNo recognition of recovery of inventory lossD)Recognize inventory loss and recovery lossNo

recognition of inventory loss nor recovery of inventory loss

A. Option A

B. Option B

C. Option C

D. Option D

Answer: A

You might also like to view...

Socioeconomic and demographic characteristics used to categorize respondents are referred to as ________

A) basic information B) classification information C) problem-solving information D) identification information E) quantification information

The effect of a conditioned stimulus is a/an ______.

A. unconditioned response B. conditioned response C. unconditioned stimulus D. neutral stimulus

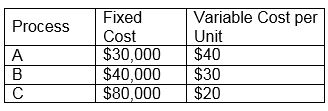

ABC Corporation would like to evaluate three production processes (A, B, and C) to accommodate the changes in demand for its products. The fixed and variable costs per unit are tabled here. Determine the most cost-effective process for an expected annual production volume of 2,000 units.

A. Process A

B. Process B

C. Process C

D. cannot be determined

Which of the following is true of PSD areas under the Clean Air Act?

a. Only limited increase in air pollution is allowed. b. New construction of a major stationary source requires a permit from the state. c. To receive a permit, a new source must show it will use the best control technology available. d. All of these. e. None of these.