The machinery in a plant is old and was designed for use by an "average-sized male.". Citing safety concerns, the company hires only average-sized males for jobs working in the plant. If a female applicant for a job at the plant is not hired and sues, a court would most likely rule that:

a. the employer violated Title VII by facially discriminating based on sex

b. the employer violated Title VII by not attempting to accommodate women so that they could work in the plant

c. the employer violated Title VII because the selection criterion of size has an adverse impact on women and is not job related and consistent with business necessity

d. the employer did not violate Title VII because the employer could establish a BFOQ based on its safety concerns

e. the employer did not violate Title VII because any adverse impact its hiring criterion created was justified as job related and consistent with business necessity

A

You might also like to view...

No apparent authority exists where the third party knows that the agent has no actual authority

a. True b. False Indicate whether the statement is true or false

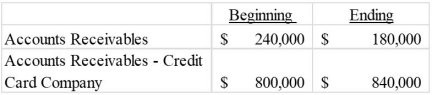

Geary, Inc. had the following sales during Year 1: Geary also had the following beginning and ending balances in the following accounts:

Geary also had the following beginning and ending balances in the following accounts: Geary, who uses the allowance method, estimated that 3% of the credit sales will go uncollected. The credit card company charges Geary a 4% fee for handling credit card transactions.Required:a) Prepare the adjusting entry for uncollectible accounts expense in general journal form. b) Prepare the entry to record the credit card sales in general journal form.c) Determine the amount of net cash

Geary, who uses the allowance method, estimated that 3% of the credit sales will go uncollected. The credit card company charges Geary a 4% fee for handling credit card transactions.Required:a) Prepare the adjusting entry for uncollectible accounts expense in general journal form. b) Prepare the entry to record the credit card sales in general journal form.c) Determine the amount of net cash

flows from operating activities during Year 1. What will be an ideal response?

Which of the following are protected categories under the Equal Credit Opportunity Act?

a. Gender, race, color, religion, and national origin b. Gender, race, color, religion, national origin, and age c. Gender, marital status, race, color, religion, national origin, and age d. Gender, marital status, race, color, religion, national origin, age, and residents of disadvantaged neighborhoods

In order to accurately assess the capital structure of a firm, it is necessary to convert its balance sheet figures from historical book values to market values. KJM Corporation's balance sheet (book values) as of today is as follows: Long-term debt (bonds, at par)$23,500,000 Preferred stock2,000,000 Common stock ($10 par)10,000,000 Retained earnings4,000,000 Total debt and equity$39,500,000 ? The bonds have a 8.3% coupon rate, payable semiannually, and a par value of $1,000. They mature exactly 10 years from today. The yield to maturity is 11%, so the bonds now sell below par. What is the current market value of the firm's debt?

A. $19,708,741 B. $22,073,790 C. $24,241,752 D. $21,679,615 E. $15,569,906