By what amount (in Canadian Dollars) would XYZ have to adjust its Loan Liability on December 31, 2016 as a result of the year's foreign exchange rate fluctuations?

XYZ Corp. has a calendar year end. On January 1, 2016, the company borrowed $5,000,000 U.S. dollars from an American Bank. The loan is to be repaid on December 31, 2019 and requires interest at 5% to be paid every December 31. The loan and applicable interest are both to be repaid in U.S. dollars. XYZ does not hedge to minimize its foreign exchange risk.

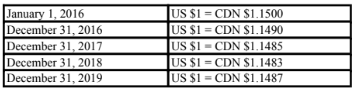

The following exchange rates were in effect throughout the term of the loan:

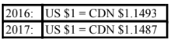

The average rates in effect for 2016 and 2017 were as follows:

A) A $5,000 increase.

B) Nil.

C) A $5,000 decrease.

D) A $2,500 decrease

C) A $5,000 decrease.

You might also like to view...

For each of the following, identify whether it would be disclosed as an operating (O), financing (F), or investing (I)activity on the statement of cash flows under the indirect method

a. ____purchased treasury stock b. ____sold equipment at book value c. ____net income d. ____sold long-term investments e. ____issued common stock f. ____depreciation expense

When implementing a new system, the costs associated with transferring data from one storage medium to another is an example of

a. a recurring cost b. a data conversion cost c. a systems design cost d. a programming cost

The three inventory accounts used in traditional costing are replaced by two inventory accounts in backflush costing

Indicate whether the statement is true or false

Douglas pays Selena $39,000 for her 30% interest in a partnership with total net assets of $105,000. Following this transaction, Selena's capital account should have a credit balance of

A) $31,500 B) $39,000 C) $35,250 D) more than $39,000