A government can increase long-run economic growth by

a. discouraging saving.

b. encouraging education and training of labor.

c. increasing the taxation of capital.

d. imposing restrictions on international trade.

e. all of the above

b. encouraging education and training of labor.

You might also like to view...

The purpose of antitrust policy is to promote competition, which leads to lower prices.

a. True b. False

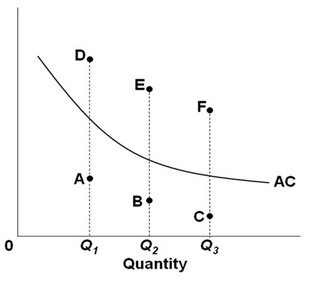

If the AC curve in the above graph represents the minimum of the average total cost curve, then examples of X-inefficiency would best be represented by point:

If the AC curve in the above graph represents the minimum of the average total cost curve, then examples of X-inefficiency would best be represented by point:

A. A at output level Q1 and point B at output level Q2. B. E at output level Q2 and point F at output level Q3. C. A at output level Q1 and point D at output level Q1. D. D at output level Q1 and point C at output level Q3.

A local government is considering a 10 percent tax on items A, B, and C. They want to tax only those goods for which the burden of the tax is lowest on suppliers. They know that the elasticity of supply of all the suppliers in question is about equal and have observed that when the price of A, B, and C rose 10 percent, total sales receipts for A and B rose 2 percent but declined 2 percent for C. From this information, they should:

A. tax A and B but not C. B. tax A, B, and C equally. C. tax C but not A and B. D. You need to know the volume of sales to determine the answer.

Government payments given to domestic producers, which reduce the world price of the traded products, are called:

A. Import quotas B. Protective tariffs C. Nontariff barriers D. Export subsidies